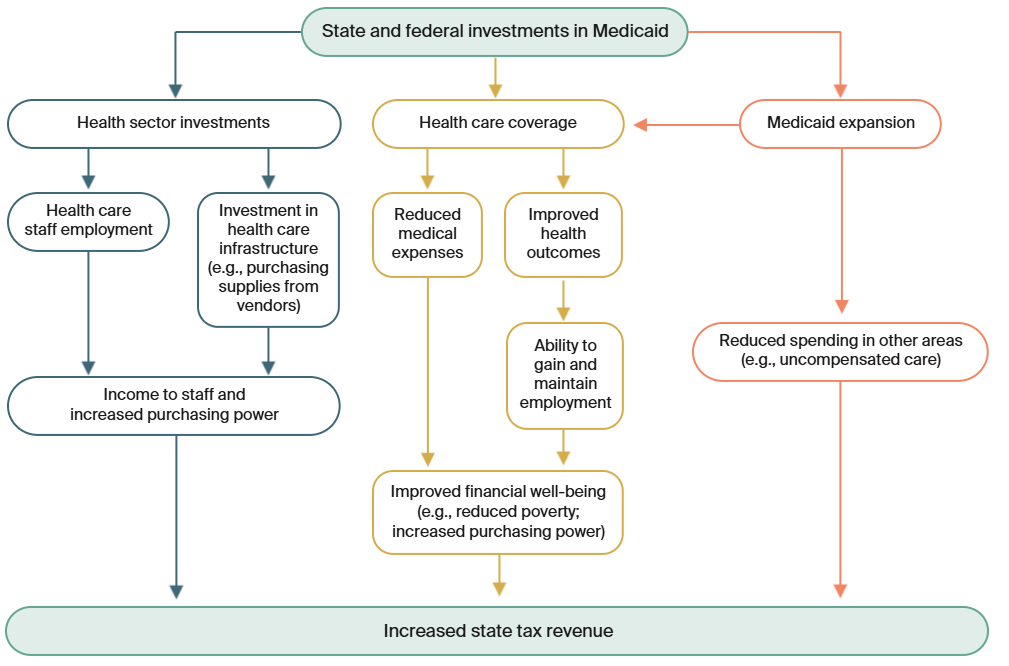

ICYMI: Medicaid makes up a sizable share of states’ budgets while providing critical financial support to the health care sector and stimulating local economies. The program accounts for an average of 30 percent of state expenditures. The Commonwealth Fund breaks down how Medicaid increases state tax revenue:

Medicaid investment is shown to have a “multiplier effect,” meaning that every dollar spent generates over a dollar’s worth of economic activity. Medicaid drives employment in the health care sector; generates state and local tax revenue; and saves money for enrollees, allowing them to spend more on items other than health care.

At the same time, reductions in Medicaid funding can negatively impact state tax revenue, employment, and individual spending power. Experts estimate that if the Medicaid cuts proposed by Congress in March 2025 — totaling $880 billion over 10 years — came to fruition, the country’s gross domestic product (GDP) would decrease by $95 billion and tax revenue would decrease by $7 billion.